December 31 is the key deadline for almost every major 2025 tax-saving move.

For physicians, these items matter because they directly affect take-home pay, investment efficiency, and year-end compensation planning. Let’s dive into a few action items to look at before 2025 closes out.

1. Tax-Loss Harvesting

Action Item: Review your taxable brokerage accounts for any investments that have unrealized losses (i.e., positions currently valued below your purchase price but not sold yet).

The Strategy: Sell these losing positions to realize a capital loss. This loss can then be used to offset any capital gains you’ve realized this year, reducing your overall taxable capital gains. If your net capital losses exceed your gains, you can even use up to $3,000 of the excess to offset your ordinary income.

Why MDs care: Many physicians hold taxable brokerage accounts on top of retirement plans; I admit this is more intermediate but it does lead to annual savings.

2. Bunch Itemized Deductions

For incomes under ~$500K, the SALT deduction cap effectively increases to ~$40K if you itemize what you plan to deduct. Consider prepaying property tax or an extra mortgage payment to “bunch” deductions into one year.

While deducting expenses can increase the amount of paperwork you do on taxes, it’s especially critical if you have done side gigs or own a small business.

Other Professional Deductions to Track (Especially for 1099/Practice Owners):

Continuing Medical Education (CME) travel and fees

Board Certification/Re-certification exams and licensing fees

Professional association dues and journal subscriptions

Brought to you by Sermo

Want to make a little side income? Check out the medical surveys at Sermo.

Physicians can earn $15,000+ through medical surveys and community contributions.

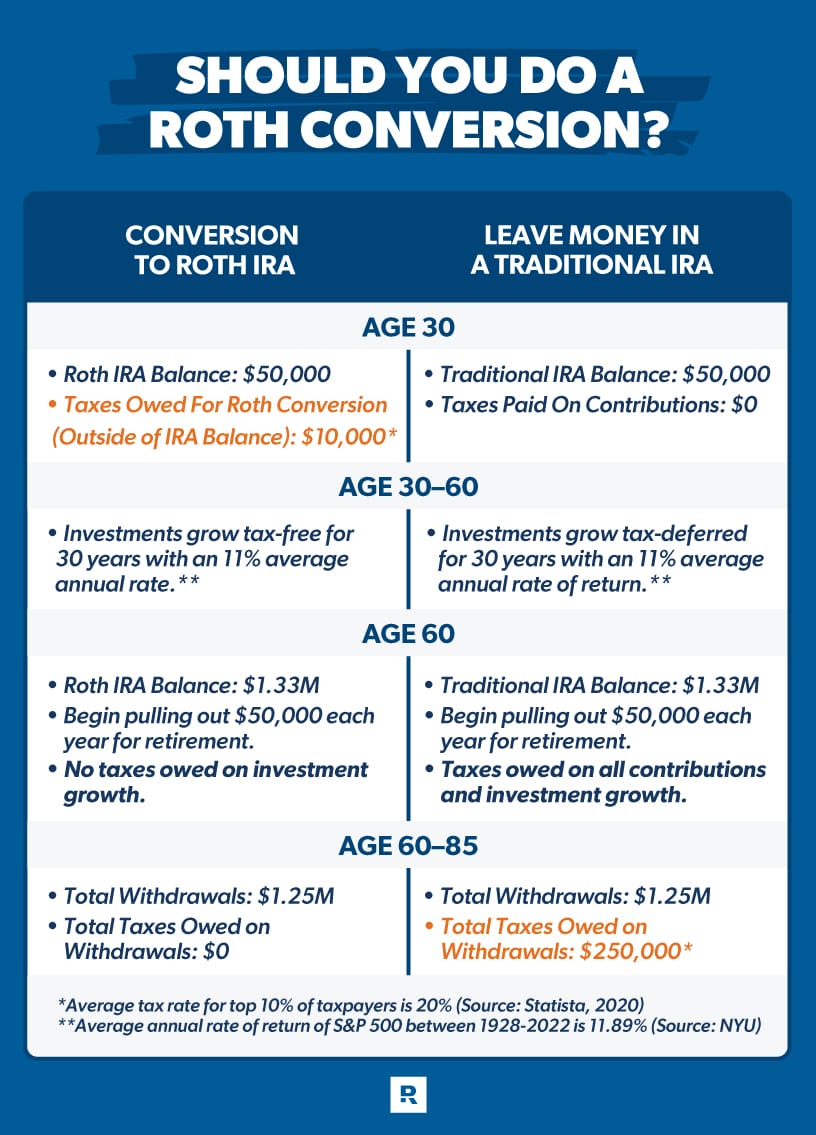

3. Roth Conversions

Evaluate converting a portion of pre-tax retirement dollars (Traditional IRA, 401(k), etc.) into a Roth account. We have more articles on investing like this one.

The Strategy: A Roth conversion is treated as taxable income in the year of the conversion, but all future growth and qualified withdrawals are tax-free. This strategy is most effective when you are in a temporarily lower marginal tax bracket than you anticipate being in during your peak earning years or in retirement.

Why should early-career MDs care? This tactic is extremely useful during periods of reduced clinical income, such as:

Fellowship or Career Transitions

Sabbaticals or Part-Time Work

A spouse's non-working year

The gap between early retirement and the start of Required Minimum Distributions (RMDs)

4. Business-Owner Tax Planning

Practice owners and physicians with significant 1099 income (locums, consulting, moonlighting) have a wider array of levers to pull before year-end.

Prepay practice expenses

Establish a Solo 401(k) and make your election before year-end

If you’re an S-Corp, run payroll before 12/31 and choose the right W-2 amount for QBI optimization (sounds like finance word soup, but is a great advanced tactic!)

How many of you run your own practice or plan to? Let us know and we can provide some free resources.

Why MDs should care: Any physician doing 1099 work, moonlighting, consulting, or running a practice falls here.

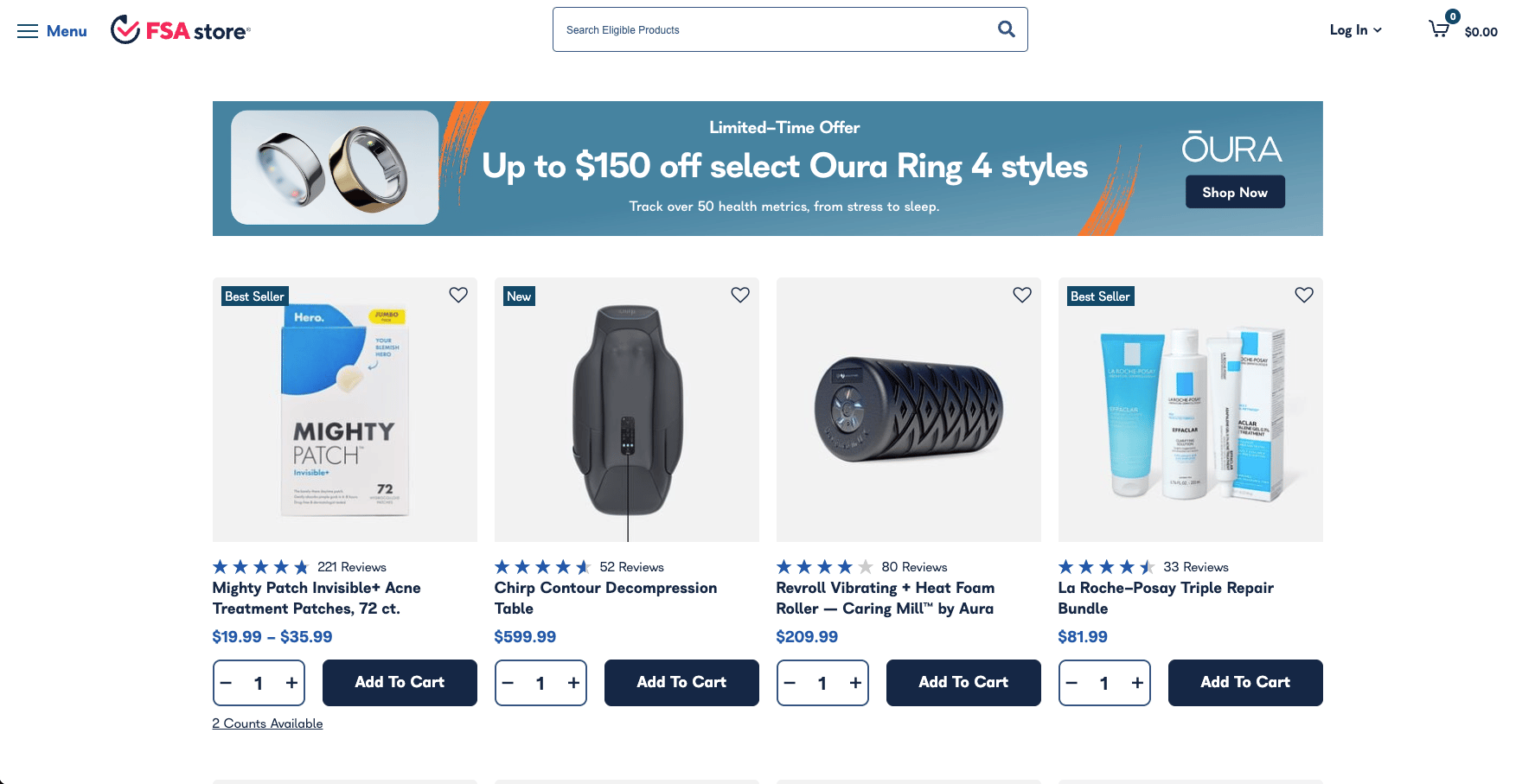

5. Flexible Spending Accounts (FSA) vs. Health Savings Accounts (HSA)

Remember to check your FSA balance immediately and spend the remaining funds prior to December 31st.

FSA (Flexible Spending Account): These funds are largely "use-it-or-lose-it" by the end of the year (or a short grace period). Funds that are not spent will be forfeited.

HSA (Health Savings Account): HSA funds roll over year-to-year, grow tax-free, and can be contributed to until the April 2026 filing deadline for the 2025 tax year.

If your hospital or group offers an FSA, ensure you spend the remaining balance on eligible items (prescriptions, vision, dental, copays, or approved health-related products) before the deadline to avoid losing your pre-tax dollars.

It’s kind of wild what products are eligible for FSAs.

6. Annual Gift Tax Exclusion

You can gift $19K per person ($38K if married) without tapping lifetime limits—often used for funding 529 plans or helping family.

Why MDs care: Good for education planning or helping kids while capturing potential state 529 tax deductions.

Main Takeaway

If you do nothing else before December 31, review your investments, retirement accounts, and deductions now—because almost all meaningful tax-saving strategies lock in by year-end.

This is the one time where financial housekeeping can easily save physicians thousands.

We build tools for physicians

Outside of this newsletter, we build tools for physicians to manage their productivity and compensation. These tools to date include:

Feedback Corner

Anything you liked this week? Want to hear more about a specific topic? Reply to the email.

Meme of the Week

Choose your path in medicine

Best,

M&H