As a resident, you're probably more focused on managing 80-hour weeks than managing your taxes.

However, did you know the average medical resident leaves $5,000-7,000 on the table each year in missed tax deductions and retirement optimization opportunities?

Let's change that.

Disclaimer: This is for informational purposes only and is not intended as financial advice. Please consult qualified financial and tax professionals for advice specific to your situation.

Resident-Specific Tax Deductions You Can’t Afford to Miss

So what are Tax Deductions?

A tax deduction is a tool that allows you to lower your taxable income, resulting in less taxes come April (tax season). Think of it like a discount on your earnings that the government allows for specific expenses. For example:

If you earn $50,000 in a year and claim $5,000 in deductions, you only pay taxes on $45,000.

Common deductions include things like student loan interest, medical expenses, or donations to charity.

By reducing the income the government taxes, deductions help you keep more of your money!

Now that we’ve had a common understanding, here’s how you can apply Tax Deductions this coming tax year.

Note: These deductions are typically only available if you itemize your deductions (Schedule A).

Here’s a general list of tax deductions for physicians. Some of the more common deductions include:

Student loan fee deductions up to $2,500

Contributions to health savings accounts (HSAs)

Contributions to pre-tax retirement savings plans, including 401(k)s, 403(b)s, 457 plans, and tax-deductible contributions to traditional IRAs.

Medical License and Exam Fees

USMLE Step 3 fees ($925 in 2024) are potentially deductible as unreimbursed employee expenses if you itemize deductions and they exceed 2% of your AGI. You cannot deduct any portion reimbursed by your program.

State medical license fees ($500-800 initial, plus annual renewal fees) qualify as deductible professional expenses.

Board exam recertification materials and prep courses are typically deductible. However, first-time board certification materials may not qualify - consult a tax professional for guidance.

Professional Development Expenses

Work-related digital subscriptions (UpToDate, Epocrates) and medical references are deductible if used primarily for work

Professional society memberships are deductible, including national organizations (AMA) and specialty-specific societies at both national and state levels

Required medical equipment (stethoscopes, surgical loupes) is deductible if not reimbursed by your employer

Conference expenses (registration, travel, lodging, meals) are deductible only if not reimbursed by your program; Meal deductions have daily limits

Dr. Chen, a second-year IM resident in Boston, saved $3,200 in taxes by properly documenting and deducting her board prep materials, required equipment and conference travel expenses.

There are likely dozens of things we didn’t mention, but everyone has a unique situation and we’d rather rely on you taking advice from tax accountants for your specific use case.

What about ways to optimize your retirement strategy?

Smart Retirement Strategies for Residents

Here’s a couple things you can do to lower your pretax income and start your retirement engine early:

Contribute to your employer's 403(b) or 401(k) if offered. These reduce your taxable income and allow you to save up to $23,000 (2024 limit) for retirement

Many teaching hospitals match 3-5% of your contributions - this is essentially free money, but check vesting requirements and minimum employment periods

Consider a Roth IRA during residency when your income is lower.

The 2025 Roth IRA contribution limit is $7,000, and you're eligible for full contributions if making less than $146,000 (phases out completely at $161,000 for single filers).

Consider this in your lower-income resident years as most attending salaries won’t qualify for Roth IRAs.

Remember that even small amounts early in your career can add up due to Compounding Growth.

"The biggest financial mistake residents make is waiting until they're attendings to start retirement planning. Even $250 a month in a 401k during residency can grow to over $100,000 by retirement age."

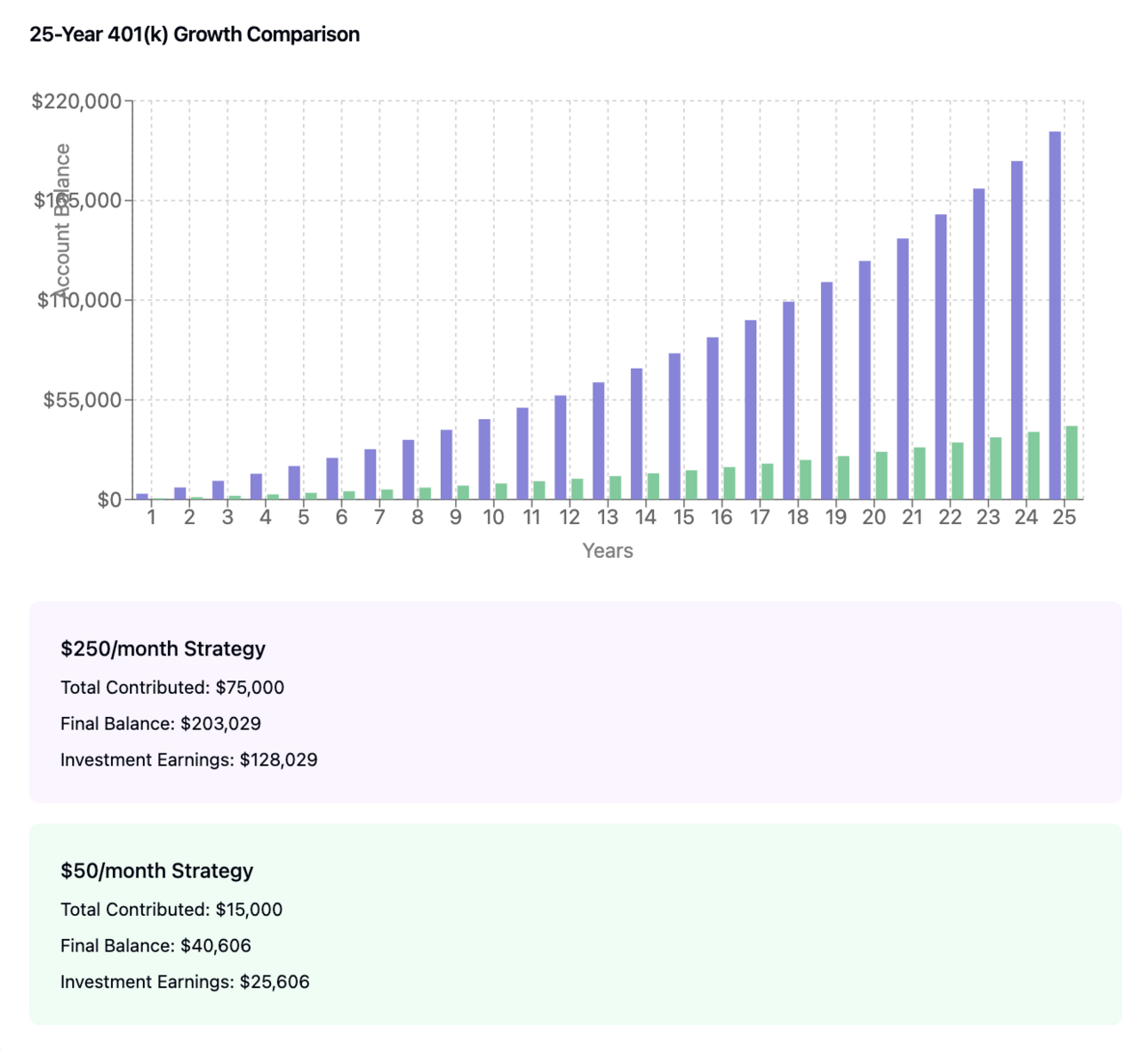

To illustrate this point, here’s what $50/mo vs $250/mo a month in retirement contributions (401k in this example) will return you over 25 years at a 7% growth rate.

For those unfamiliar, the market on average will grow 7% a year.

Compounding works and it doesn’t take a lot to move the needle.

According to a 2022 Medscape survey, only 39% of residents actively contribute to retirement accounts during training, despite the long-term advantages of compound growth.

Financial Planning During Residency

We’ve written more in-depth on some of these topics in the past, however, here’s a refresher on things to consider:

Student Loan Management

Public Service Loan Forgiveness (PSLF) qualification strategies

Income-driven repayment plan optimization - some employers will offer repayment plans as part of the benefits package

Housing and Relocation

Moving expense deductions for first job (if more than 50 miles)

Home office deductions for study space and administrative work (doesn’t apply to all employed professionals)

State-specific tax credits for healthcare workers

Professional Liability Insurance

Tail coverage deductions

Moonlighting insurance considerations

Some action items for you:

Create a spreadsheet for tracking unreimbursed expenses related to work

Plan to file with itemized deductions via the Schedule A form if relevant

Set up automatic retirement contributions, even if small (we will go over this in detail in future newsletters)

Review student loan repayment strategy quarterly

Start maintaining records for PSLF qualification

While mastering medicine is your primary focus during residency, mastering these financial strategies can significantly impact your long-term financial health.

Just as you wouldn't skip a critical step in a medical procedure, don't skip these essential financial steps during your training years.

Your future attending self will thank you.

Feedback Corner

Anything you want us to cover in more depth? We’re always open to feedback.

Meme of the Week

When Uncle Sam asks for your tax payment.

All the best,

M&H