Happy National Doctor’s Day!

We want to shout out all the selfless and hard-working physicians out there.

You’re doing a great job. Thanks for making the world a better place.

Brought to you by Sermo

Want to make a little side income? Look no further than Sermo. Physicians can earn $15,000+ through medical surveys and community contributions.

“The surveys are flexible and simple to do because they're within your own scope of knowledge and specialty.”

If you're a resident trying to remember what day it is, or an attending juggling charts interns, consults, and childcare, managing your own investments can feel like one more thing you don’t have time for.

But here’s the good news: you don’t need to become a stock-picking genius to grow your wealth.

In fact, the most effective investing strategy for most physicians isn’t flashy. It’s boring.

And boring is beautiful.

It’s called index fund investing, and it’s how thousands of financially independent physicians got there—without trading a single stock.

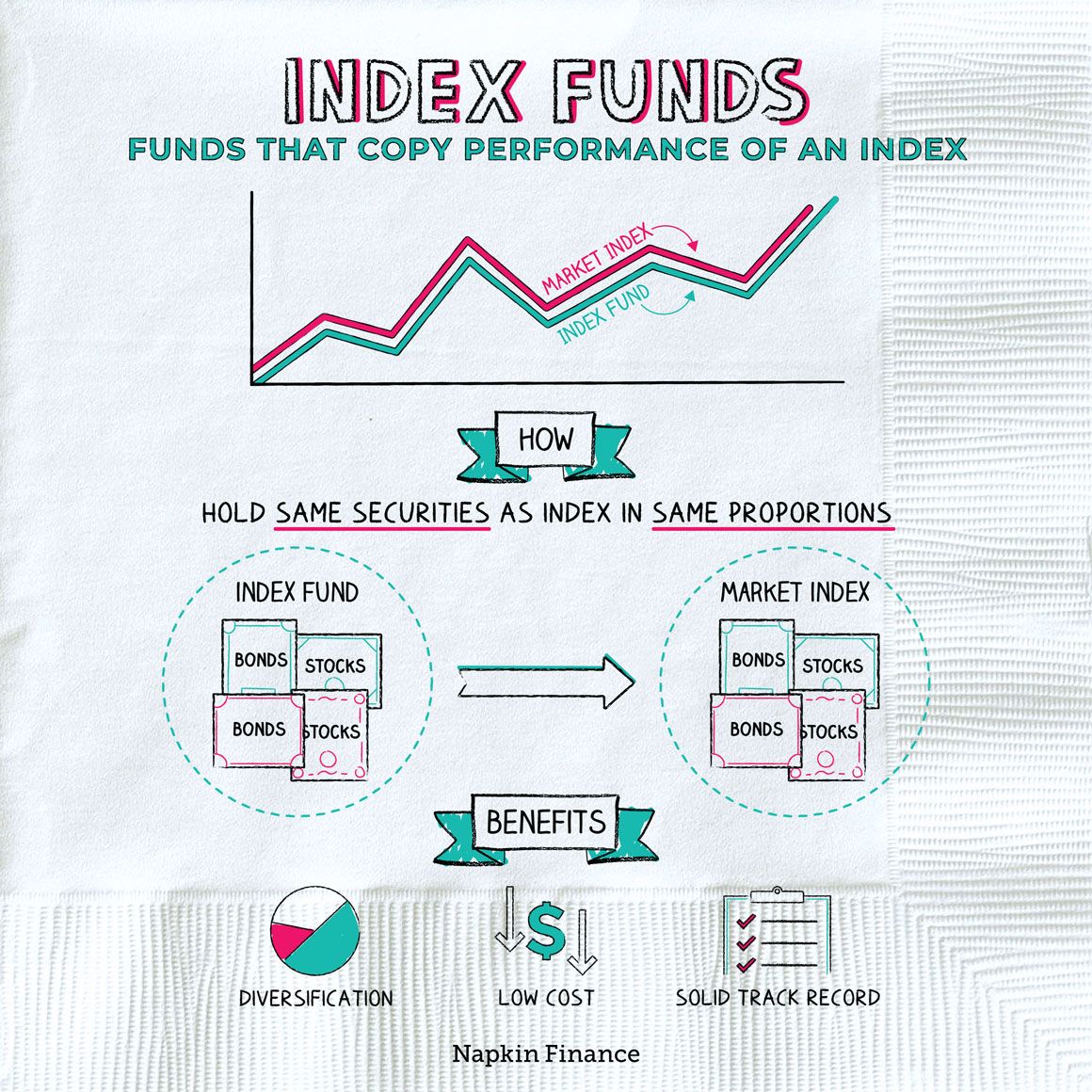

What’s an Index Fund, and Why Should You Care?

Index funds for beginners

An index fund is a bundle of stocks designed to mirror the performance of a specific market index like the S&P 500 (500 leading US companies).

Instead of buying one company’s stock and hoping it performs well, you’re buying a slice of everything like Apple, Amazon, Costco, Google, and hundreds more.

You're not betting on the next big winner.

You're betting that the entire market will grow over time. (And historically, it has—averaging 7–10% annual returns after inflation.)

Why Index Funds Are Perfect for Physicians 🩺

You don’t have time to monitor the market

Ignoring lack of expertise and competing with the retail and professional traders, your life is busy.

Rounds, notes, and surprise consults don’t leave room for day-trading. Index funds are an easy way to get in the market.

Your salary gives you the edge (eventually)

With consistent high income (after residency), you can regularly invest over time—what’s called “dollar cost averaging.”

This means you’re not trying to time the ups and downs of the market. You’re investing consistently over a period of time that in the long-run will net you positive gains.

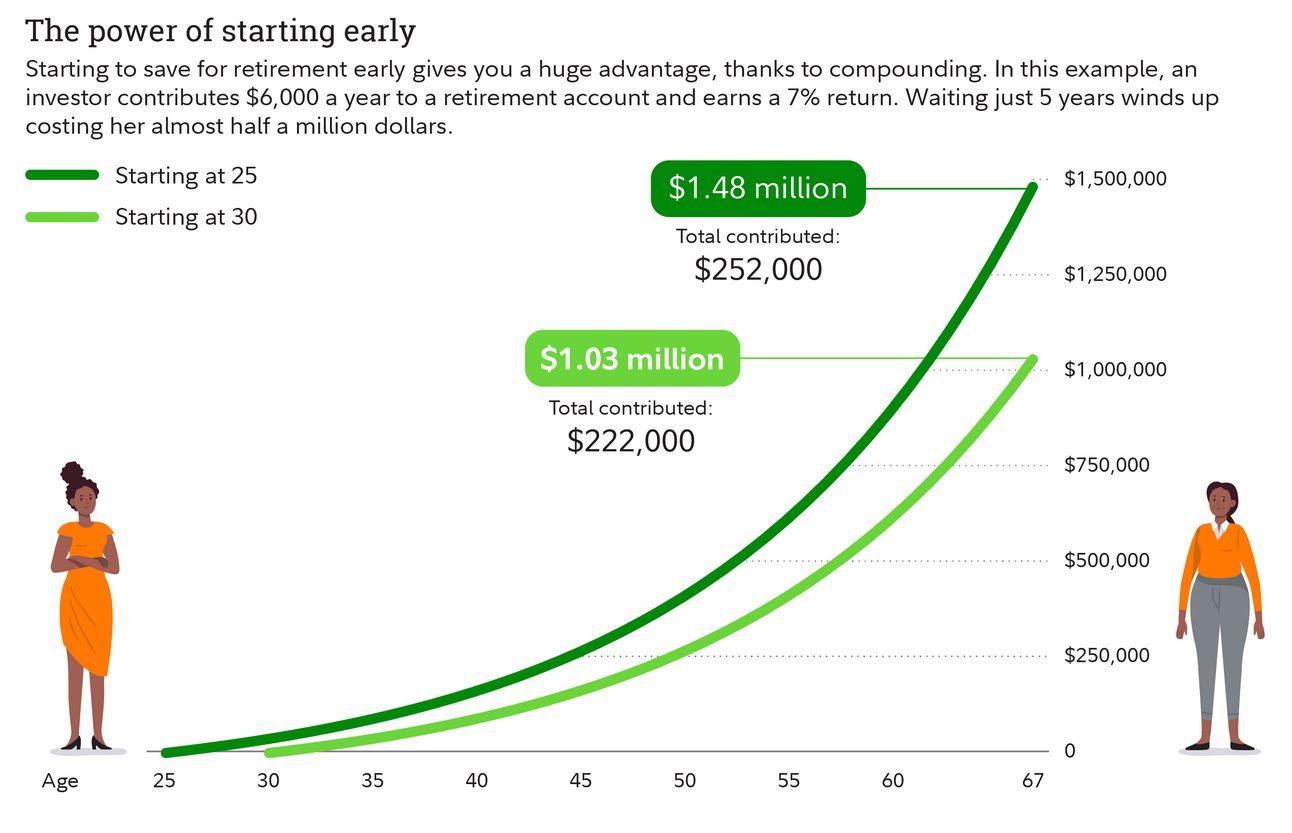

But remember, it’s better to start early.

Start investing even during residency. A little goes a long way.

They outperform most active investors

Despite all the sophisticated methods of trading, data shows that over long time periods, index funds often beat hedge funds, financial advisors, and even Ivy League endowments.

But What If the Market Drops? It will. That’s normal. The key is staying invested, not trying to time the market. (Spoiler: no one does it well—not even the pros.)

Translation:

✅ Low effort

✅ Low fees

✅ Long-term growth

✅ Zero stress about “what stock should to buy next”

What to Buy: A Simple Starter Portfolio

If you only remember one thing: stick to low-cost, broad-market index funds.

Here are three solid examples (not financial advice—just what many DIY investors start with):

Investing in these funds will diversify your portfolio, while giving you some control over exposure, risk, and upside/downside.

Most physician investors start with an 80/20 or 90/10 stock-to-bond allocation early in their careers, then shift toward more bonds as they approach retirement since bonds have historically been safer, although lower upside.

💡Tip: Use a Roth IRA, 401(k)/403(b), or Backdoor Roth IRA to invest in these funds tax-efficiently.

Where to Buy: Choose an Easy Platform

Don’t overthink this. You just need a brokerage account where you can buy index funds and set up automatic transfers.

Top options:

Fidelity

Vanguard

Charles Schwab

Betterment or Wealthfront (for more automation, slightly higher fees)

Whichever you choose, check:

No account fees

No trade fees on index funds

Easy auto-deposit setup

How to Invest: Make It Automatic

This is the real secret. Set it, forget it.

Pick your index fund(s)

Choose a set amount to invest monthly (e.g. $500–$2,000, depending on your budget)

Automate it through your brokerage

The earlier and more consistently you do this, the faster compound growth kicks in.

Even $500/month invested in a simple index fund earning 8% annually turns into ~$350,000 in 15 years. No stock picking. No stress.

TL;DR

Question | Answer |

What should I buy? | A low-cost index fund like VTI (total US market) |

How often should I buy? | Monthly or biweekly— |

Do I need to monitor it? | Nope. Check once a year to rebalance, if at all |

Can I beat the market? | Probably not. But you can ride it efficiently |

Action Items

✅ Open a Roth IRA or brokerage account

✅ Choose one low-cost index fund

✅ Set up auto-transfers, even if it’s just $100/month

✅ Stop checking the market. You have patients to see.

Feedback Corner

Anything you liked this week? Want to hear more about a specific topic? Reply to the email.

Meme of the Week

Best,

M&H