Today we’re chatting about investing for retirement.

There’s a ton of information online about the topic. However, we wanted to talk about the mindset and early actions worth taking to start building your nest egg during residency, and even early attendinghood.

There’s no magic formula for this stuff.

You’ll need to set up investment and retirement accounts, automate money transfers into those accounts, pick stocks and index funds to invest in, and then let compounding do the rest. Simple, right?

Let’s dig in a little bit more about smart insights that are specific to you, an MD.

Was this email forwarded to you? Subscribe here.

Your 403(b) is “Free” Money – Stop Leaving It Behind

A 403(b) plan is a retirement savings plan, similar to a 401(k), available to employees of public schools, tax-exempt organizations, and certain religious institutions.

In your case, if you work at a tax-exempt hospital system, your employer likely has a 403(b) retirement plan. (Definitely double check this point!).

403(b) allows eligible employees to save for retirement through tax-deferred contributions and potentially benefit from employer matching contributions.

Tax Advantages:

Contributions, i.e. the money you put in, are typically made on a pre-tax basis, meaning they can reduce current taxable income. Simply put, the more money you put into the 403(b), the less money you took home. This can lower your tax liability.

Earnings in your 403(b) grow tax-deferred until retirement. Some plans also offer Roth options, where contributions are made after-tax, but withdrawals in retirement are tax-free.

Investment Options:

403(b) plans offer a variety of investment options, including mutual funds, annuities, and sometimes custodial accounts. Consult your employer’s plan to see what you can invest in!

Contribution Limits:

If you’re under 50, you can invest up to $23,500 into your account. Our audience is mainly residents and new attendings, so I won’t comment on the additions that more experience physicians are able to add.

The main point I want to make is that if your employer offers a match, you should probably take it. Some hospitals offer 3-5% matching. If you’re able to get this “free” money, you should focus on maximizing this before you start looking at your Roth IRA.

For example, if your employer matches 5% and you make $60K, they’ll throw in $3,000 a year just because you’re saving for yourself. That’s a 100% return instantly. But over a third of residents skip it entirely. Don’t be one of them.

We did the math

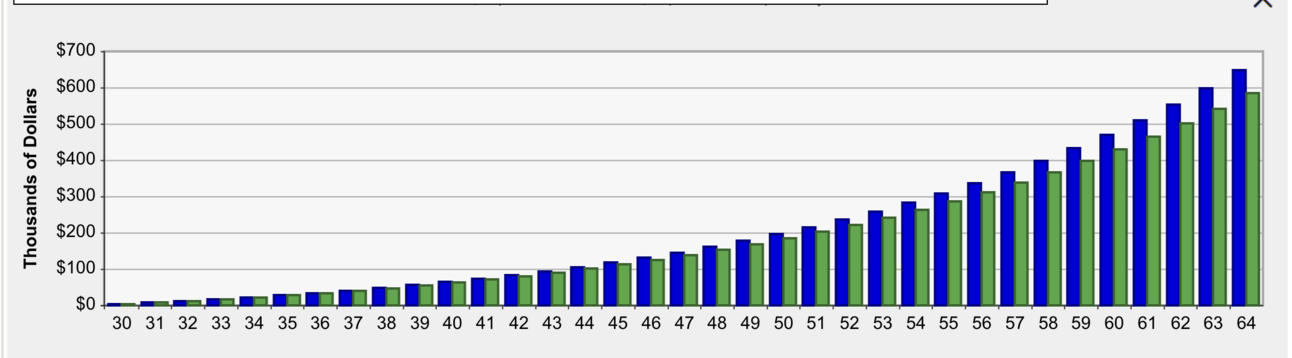

Starting at 30 years old during residency, with a salary of $60k and contributing $150 monthly ($1,800 yearly) with:

3% employer match ($1,800/yr)

7% standard investment returns

your 403(b) becomes $150,000 by mid-career, and more than $500k by retirement age. Not considering other investment accounts, that's solid wealth starting from resident contributions and zero work, just discipline.

Check out the Bankrate 403(b) calculator to see how your specific math works out.

For those feeling a little more savvy, check out Roth contributions. Roth means you pay taxes now, rather than later. You should consider a Roth 403(b) if you plan to be in a higher tax bracket during retirement.

Just know that once you’re mid-to-late attending-level and earning $300k+, that calculus might change.

Brought to you by Sermo

Want to make a little side income? Look no further than Sermo. Physicians can earn $15,000+ through medical surveys and community contributions.

“The surveys are flexible and simple to do because they're within your own scope of knowledge and specialty.”

The Backdoor Roth IRA - Your High-Income Escape Hatch

A Roth IRA is one of the best retirement accounts you can have.

You put in money that's already been taxed, it grows for decades, and when you retire you pull it out completely tax-free.

The problem?

Once you make more than $150k (single) or $236k (married), you can no longer contribute. As an attending, you'll blow past this limit quickly.

Enter the Backdoor Roth IRA. It's a perfectly legal workaround that lets high earners contribute to a Roth IRA anyway.

(Most resident reading this section will gloss over it because your pay is still repressed during training. I encourage you to understand the strategy anyways).

How a Backdoor Roth works:

Open a traditional IRA account (any broker)

Contribute up to $7,000 (the 2025 limit) using after-tax dollars

Immediately convert that money to a Roth IRA (pretty easy within modern broker platforms)

Pay taxes on any gains during the conversion (usually zero if you do it quickly)

Do it again next year! Now you’re able to take advantage of a Roth’s tax-free growth while on a higher salary

You're basically using the traditional IRA as a temporary holding spot before moving the money to the Roth IRA.

An image for the visual learners. From our friends at the WCI.

The fine print

If you already have money in other traditional IRAs, the conversion gets more complicated due to something called the "pro-rata rule."

Most residents don't have this issue, but check your accounts first.

Also, keep good records. The tax man wants to see documentation of your conversion when you file taxes.

"I had no idea I spent $400 on coffee last month." – PGY-2

You're not bad with money. You're just busy keeping people alive.

We’re working on an app for residents and new attendings called Rounds. The basic premise is that it tracks your spending, saving and debt in very personalized ways.

Each week, you spend five minutes with Rounds to go over your spending, while it helps you stay on top of your money goals. It’s less about charts and graphs, and more about managing your mindset and keeping a pulse on things.

✓ Automatically tracks spending (no manual entry)

✓ Weekly 5-minute "rounds" to review your finances

✓ Made specifically for early-career MDs

✓ Building other tools like debt calculators, anonymous specialty salary database, etc.

Want to learn more? Reply to this email!

Meme of the Week

To the good ol’ days.

The good ol’ days

Feedback corner

Anything you liked or disliked this week?

Want more visuals, more jokes, or maybe less? Let us know. You can reply to this email and tell me how you really feel.

Talk soon,

M&H