Was this email forwarded to you? Subscribe here.

Debt talk is never fun, especially when diving into the world of student loans. But knowing exactly what changes on August 1st can save you four‑ and five‑figure mistakes down the line.

Beginning that date, the Department of Education will let interest accrue again on all loans sitting in the automatic SAVE forbearance. Monthly bills are still paused until at least the fall of 2025, yet your balance will begin ticking upward unless you act.

Knowing this, let’s chat through the new SAVE and income-based loan repayment strategies.

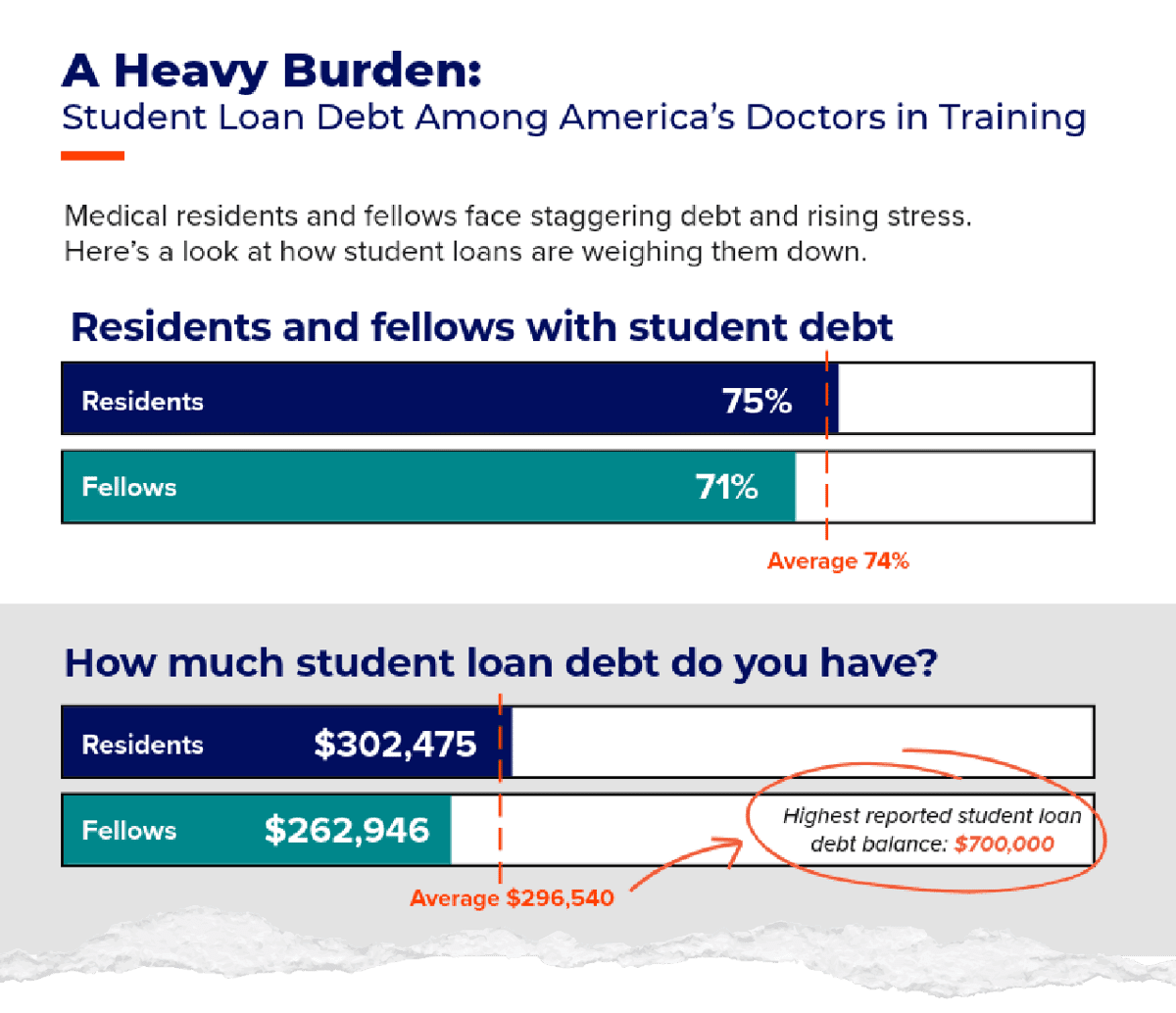

Panacea Financial’s latest 2025 Residents & Fellows Survey Report details:

53% of trainees said their financial stress was at 8+ out of 10.

75% are stressed about student loan debt

Does this strike a chord?

Surveyed physicians report a growing debt burden

What SAVE Was—and Why It’s on Ice

Saving on a Valuable Education (SAVE) launched in 2024 as the most generous income‑driven repayment (IDR) plan:

5% of discretionary income for undergraduate debt, 10 % for graduate, with any unpaid interest wiped so balances could not grow.

Lawsuits derailed key pieces of the program in February this year, and a federal judge later ruled the whole plan illegal. While the Department of Education appeals, borrowers enrolled in SAVE were placed into an “administrative forbearance” that paused payments and, until now, interest.

That interest‑free window will end August 1.

Where SAVE fits inside Income-Driven Repayment options

“IDR” is the umbrella term for plans that tie loan payments to income and forgive remaining balances after 20–25 years (or just 10 years if you also qualify for Public Service Loan Forgiveness).

As of writing (July 2025), the IDR plans that still exist are:

IDR plan | How the payment is set | Forgiveness timeline* |

|---|---|---|

Income‑Based Repayment (IBR) | 10% (new borrowers) or 15% of discretionary income | 20 yrs (new) / 25 yrs (old) |

Pay As You Earn (PAYE) | 10% of discretionary income | 20 yrs |

Income‑Contingent Repayment (ICR) | 20% of discretionary income or a 12‑yr fixed schedule, whichever is lower | 25 yrs |

*Years of qualifying payments; you must re-certify income annually. Federal Student Aid

PSLF Is Not A Plan, But Separate Program

Public Service Loan Forgiveness (PSLF) is not a repayment plan, but a separate program sitting on top of IDR plans that wipes out your remaining Direct‑Loan balance after 120 qualifying monthly payments (≈ 10 yrs) while you work full‑time for a government or 501(c)(3) nonprofit employer and submit annual employment certifications.

To count, those 120 payments must be made under a qualifying plan—any of the IDR plans above or the 10‑year Standard Plan.

Who’s Impacted By This Change to SAVE?

Around 8 million borrowers currently enrolled or applied for SAVE and still sitting in the automatic forbearance.

This includes direct loan borrowers who entered SAVE for Public Service Loan Forgiveness (PSLF), Income‑Driven Repayment (IDR) forgiveness, or pure cash‑flow relief.

The Decision Tree For Those With Loans

A. Pursuing PSLF

Stay in Forbearance | Switch to New IDR (IBR, PAYE, ICR) |

|---|---|

- No payment due now - Interest starts Aug 1 — consider paying it monthly to avoid balance creep - Use PSLF Buy‑Back later to retro‑credit these paused months toward the 120 payments | - Apply for new IDR - Payments will count toward your 120 required right away - Expect payment similar to what you’d pay during Buy‑Back anyway |

B. Pursuing 20‑ or 25‑Year IDR Forgiveness

Switch ASAP. Months spent in forbearance do not count toward IDR forgiveness and there is no Buy‑Back option.

Use the FSA Loan Simulator to compare IBR vs. PAYE.

C. Not Seeking Forgiveness

You can:

Stay in forbearance through mid‑2026 (or earlier if the courts lift it) and pay just the accruing interest, or

Switch to a new IDR now and resume full amortizing payments.

If you can spare cash before Aug 1, making a lump‑sum toward principal now maximizes interest‑free payoff.

Brought to you by Sermo

Want to make side income during training? Check out Sermo. With Sermo, physicians can earn thousands through medical surveys.

“The surveys are flexible and simple to do because they're within your own scope of knowledge and specialty.”

15‑Minute Action Checklist (Before August 1st)

Confirm loan status in your servicer portal — make sure all loans say “Administrative Forbearance.”

Run numbers in the Federal Student Aid Loan Simulator for IBR, PAYE, ICR.

Decide:

Stay in SAVE forbearance

Apply for a new IDR plan (submit application online; keep proof)

Update income docs if switching plans to avoid processing delays.

Calendar reminders

Aug 1: Interest starts.

Oct 1: Re‑check servicer for any unexpected bills.

FAQs

Will my payment jump if I switch? Likely yes. Example: $60k income, $30k debt → ~$217 on SAVE vs. ~$310 on IBR.

How long will the forbearance really last? Current guidance is until mid‑2026 or until courts settle the SAVE case and servicers can bill accurately.

Can I refinance privately? Possible, but you’d forfeit federal protections and PSLF eligibility. Latest rates (July 2025) hover around 6% fixed for physicians with steady income.

Resources

In Summary

We know this stuff can be overwhelming. But we’re confident in your ability to learn it.

As long as you equip yourself with the knowledge and understand your exact debt situation, you’ll be able to handle any program change that comes about.

Keep an eye out for future articles on student loan management.

We’re working on tools for you

Based on the loan-related content this week, we’ve started building a physician-specific loan repayment calculator designed to help you build your strategy.

While we don’t currently cover every use case, we’re interested to hear what else you might find helpful.

@themdnewsletter Debt payoff strategies for MDs

Best,

M&H