Was this email forwarded to you? Subscribe here.

Brought to you by Sermo

Want to make a little side income? Look no further than Sermo. Physicians can earn $15,000+ through medical surveys and community contributions.

“The surveys are flexible and simple to do because they're within your own scope of knowledge and specialty.”

You’ve invested over a decade into your training. Late nights. Board exams. Crushing student debt. What happens if something suddenly takes away your ability to practice?

For physicians, losing your income isn’t just a financial inconvenience. It’s a total derailment of everything you’ve built.

That’s where disability insurance comes in. But the options are confusing, the policies are filled with jargon, and the pressure to “buy now before rates go up” can feel like a scam.

Let’s make sense of it all.

Why Disability Insurance Actually Matters for Doctors

If you can’t work due to injury or illness, disability insurance steps in and replaces a portion of your income.

This is especially important for physicians because you’re in a high-income, high-skill profession. If a hand tremor, back issue, or mental health condition prevents you from practicing, you can’t just “switch to another job.”

You need a way to ensure you can financially support yourself.

That’s why physicians need more protection than most. Disability insurance is the tool to achieve this.

Plenty of residents have questions about this

When Should You Get It?

The best time to buy is during residency or fellowship. Why?

Your rates are lower because you’re younger and (hopefully) healthier.

You lock in your health rating even if your health changes later.

Some residency programs offer “guaranteed issue” policies, meaning you can get coverage with no medical exam and no chance of being denied.

Even if you’re already an attending, it’s still worth getting coverage now before your health changes or premiums go up.

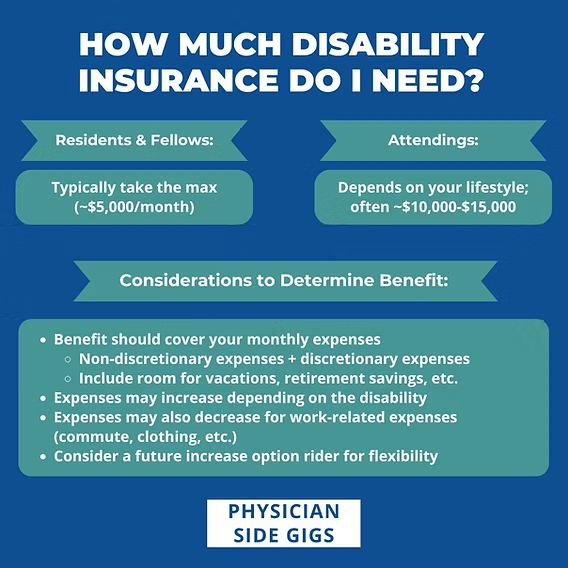

How Much Coverage Do You Need?

Start with this rule of thumb: aim to replace 60-70% of your after-tax income.

So if your take-home pay is around $10,000/month, you’d want a policy that pays $6,000–$7,000/month if you’re disabled.

If you’re still in training, start with the maximum available to residents, usually $5,000 a month. You can always increase coverage later as your income grows.

What to Look For in a Policy

Not all policies are created equal. These features matter:

Own-Occupation Definition: This is non-negotiable. It means if you can’t work in your specialty (e.g., orthopedic surgery), you still get paid, even if you could do something else, like teaching or consulting. Without this, your claim could be denied if you’re “able to work” in a different job.

Residual or Partial Disability Coverage: This kicks in if you can work part-time or lose part of your income. It’s useful for conditions that don’t totally prevent you from working, but still limit what you can do.

Non-Cancelable and Guaranteed Renewable: The insurer can’t raise your rates or cancel your policy as long as you pay your premiums.

Future Increase Option (FIO): This lets you raise your coverage later without going through another medical exam. Very helpful as your income grows.

What It Costs

Premiums are usually 1–3% of your annual income. For example:

A resident might pay $30–100/month for $5,000/month of coverage.

An attending earning $250K might pay $250–500/month for $15,000/month of coverage.

Yes, it’s pricey, but it’s matched to your income. You insure your car and apartment, so why not your biggest asset? → Your ability to earn.

What If You Already Have Coverage Through Work?

That’s a good start, but it’s usually not enough. Hospital or employer-provided policies often:

Replace less income

Are not own-occupation, and can go away if you leave your job

Can be canceled if you leave your job

Are taxable if your employer pays the premium

Translation: it’s a nice perk, but not enough. Get your own individual policy. It’s portable, tailored to your specialty, and way more reliable.

Where to Get It

Look for an independent agent who works with multiple carriers and has experience with physicians. They can help you compare options and walk you through the process without pushing you into one company.

Ask these questions:

Do they specialize in disability insurance for doctors?

Can they compare policies across multiple companies and explain your options clearly (no pressure sales)

Do they offer white-glove help during the application and medical screening process

✅ Action Items This Week

If you’re a resident or fellow: ask your program if they offer guaranteed issue coverage.

If you’re a new attending: get quotes for own-occupation coverage now before your health changes.

If you already have a policy: review the fine print. Look for own-occupation language and residual benefits.

Disability insurance isn’t fun, but it’s one of the most important financial moves you’ll ever make.

It’s the safety net that ensures all your sacrifice and training don’t vanish with one bad accident, diagnosis, or chronic condition.

Protect your income and sleep better at night. Your career is worth insuring.

Meme of the Week

Never a dull moment

Feedback Corner

Anything you liked this week? Want to hear more about a specific topic? Reply to the email.

Best,

M&H