Happy Match Week(end) to all who matched!

Only 3 more months till you’re a fully-fledged Intern :)

The road to becoming a physician is demanding mentally, physically and financially (and perhaps spiritually?).

Between tuition, books, exams and boards, moving, starting a family, and the occasional (or frequent) coffee-fueled round, it's easy to feel like your wallet is hemorrhaging cash.

Budgeting is often a scary word that comes with the baggage of making significant lifestyle changes. But, it doesn’t have to be.

Instead of changing your habits, here’s how to optimize what you’re already doing to save money effortlessly during your training years and beyond.

Optimize Your Credit Card for Maximum Rewards

Be like The Points Guy—but on your terms. If you’re already swiping daily, you might as well collect perks. No need to overcomplicate. Pick one card that rewards your main spending category:

Groceries/Gas: American Express Blue Cash Everyday (no annual fee)

Conferences/Interviews: Chase Sapphire Preferred ($95 annual fee, but you can score big in travel rewards)

Simple & Automatic: Citi Double Cash (no annual fee—straight 2% back).

Paying Rent?: The Bilt Mastercard (no annual fee—earn points on rent).

Credit card points are a deep rabbit hole. Probably best to keep it simple for now.

💡Tip: Use a recurring calendar alert to pay off your balance every month. Interest fees are the real buzzkill. If you’re curious about diving deeper into the points rabbit hole, check out r/churning or The Points Guy. (But fair warning, it’s a steep slippery slope.)

Make the Most of Student and Doctor Discounts

Instead of cutting back on essentials, check for discounts on things you're already paying for. Good candidates are existing medical expenses, subscriptions, and travel.

Medical expenses

UptoDate & Medical Journals – Many schools provide free access—verify before subscribing.

Scrubs and equipment: FIGS, Jaanuu, Mandala, and plenty of other brands have student/healthcare worker discounts. Also, scope out hospital surplus sales or online discount stores before paying retail.

Subscriptions

Amazon Prime Student – Half the price of regular Prime

Apple Music & Apple TV+ – $5.99/month (50% off), includes Apple TV+ free. (Apple Student Plan)

Microsoft 365 – Free for students, including Word, Excel, and PowerPoint. (Get it here)

Adobe Creative Cloud – 60% off the full suite (Photoshop, Premiere Pro, etc.). (Adobe Student Plan)

Food/Health

Local Restaurants & Gyms – Flash your student ID (we know you still keep your med school one) for hidden discounts. No one has ever received anything without asking.

Grocery Stores – Some local and regional grocery stores offer student or healthcare discount days.

Transportation & Travel:

Amtrak – 15% off train tickets for students. (Amtrak Student Discount)

Airlines (Delta, American, United, etc.) – Some airlines offer special student pricing through platforms like StudentUniverse (Check here).

Public Transit – Many cities offer discounted metro/bus passes for students (check with your local transit authority).

We’re also testing out a new app called Autopilot. It works by watching for prices of flights you’ve already booked. As soon as your flight price drops, Autopilot gets you airline credit for the difference. Pretty neat!

💡Tip: Remembering which companies offer discounts and tracking them down can be overwhelming. If you want a “good enough” approach, there are two options:

ID.me is a secure verification platform that provides discounts and exclusive deals for students, military personnel, first responders, teachers, and medical professionals.

ID.me is typically best for electronics, travel, medical gear, fashion, services

UNiDAYS is a student-only discount platform that partners with brands to offer exclusive savings for students.

UNiDAYS is best for lifestyle perks like clothing, tech, subscriptions, fast food

Automate Your Budgeting Without Extra Work

If you already use a debit or credit card, let free apps track your spending for you.

You Need a Budget (YNAB): Very granular, hands-on approach. Great if you want to assign every dollar a job.

Rocket Money: Known for tracking subscriptions and giving a top-level view of your net worth.

Monarch Money, Mint, Personal Capital: Each has its own spin on budgeting, net worth tracking, and investment oversight.

Having a hard time deciding which app to use? Pick whatever interface you' actually like opening. If a sleek design keeps you engaged in your finances, that’s not shallow; it’s practical.

💡Tip: Managing a budget day-to-day can be overwhelming. It’s okay to only look at your budget once a month to make sure you’re spending within your limits and make adjustments heading into a new month.

Keep Your Lifestyle the Same, Just Make It Smarter

You don’t have to cut back—just make smarter choices within your current habits.

Buying coffee daily? Use a rewards program like Starbucks Rewards or Dunkin’ Perks.

Driving to the hospital? Use apps like GasBuddy to find the cheapest fuel.

Budgeting doesn’t mean cutting everything out—it means being intentional about the spending you already do. By optimizing your current habits, you can save money effortlessly and set yourself up for financial success.

Feedback Corner

Anything you liked this week? Want to hear more about a specific topic? Reply to the email.

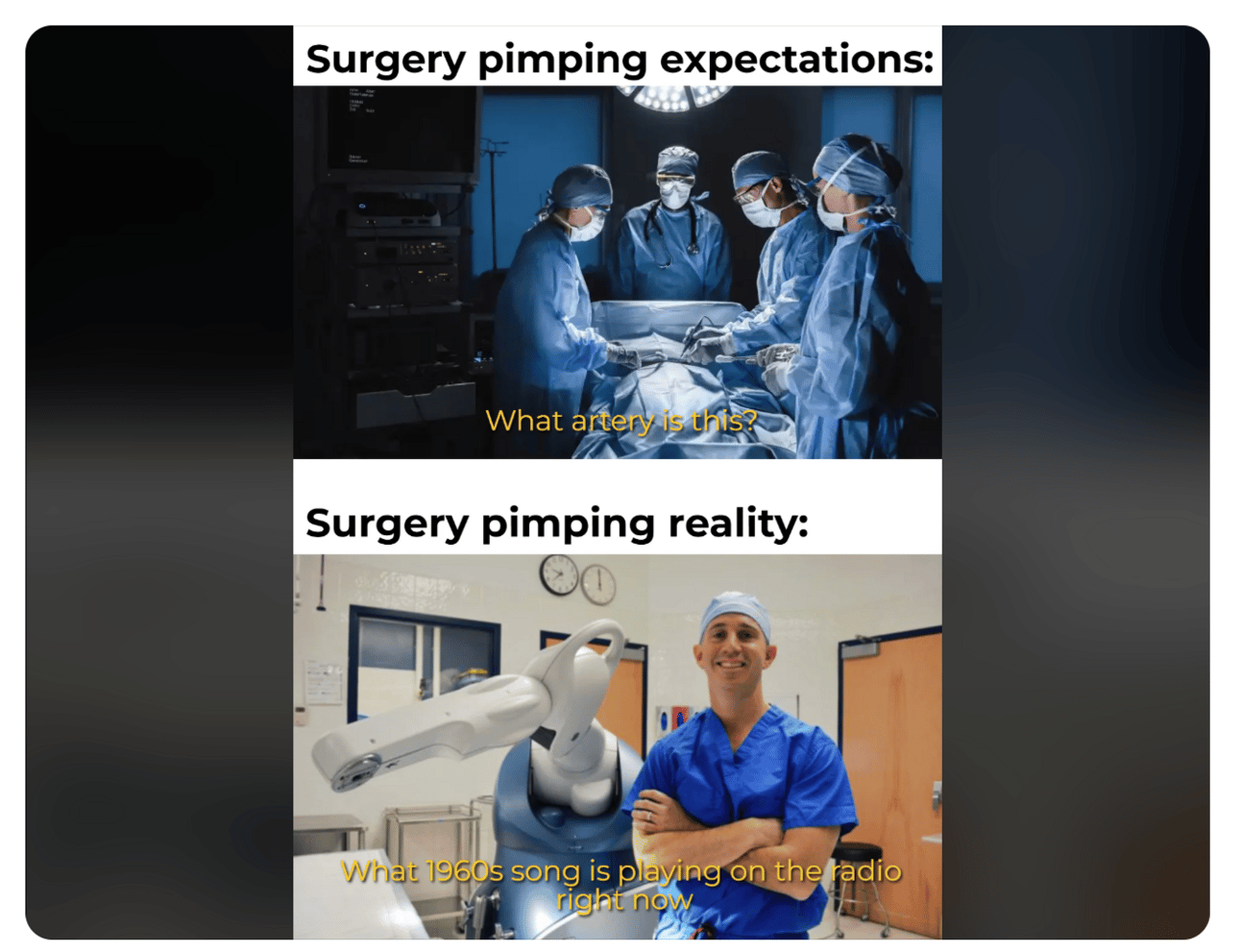

Meme of the Week

As seen on r/medicalschool

Best,

M&H