Subscribe | Advertise | Try Our Tools (Coming Soon)

In Part 1 we discussed the paradox of investing as physicians and a few ways you can start block-and-tackling your investment portfolio. There are seemingly infinite approaches and mistakes you might make with investing, some of which we’ll discuss in this article.

Of course the nitty gritty of investing doesn’t make for a fun read all the time, but we’ll do our best to keep it moving. Ok…shall we?

Brought to you by RVU Tracker

Why do physicians track RVUs personally?

✅ Catch "coding errors" (that always favor the hospital)

✅ Prove your worth during contract negotiations

✅ Hit RVU targets for partnership track

✅ Build leverage for your next job interview

"Caught $18K in missing work RVUs my first year."

Finally, RVU tracking that doesn't suck.

With RVU Tracker:

📱 Log RVUs in 10 seconds between encounters

📊 See real-time dashboards to know exactly where you stand

💰 Search specialty-specific CPT and HCPCS codes and benchmarks

📈 Export professional reports for reconciliation

Common Investment Mistakes (And How to Avoid Them)

Mistake #1: Keeping Too Much Cash

Many physicians treat their savings account like a security blanket, stockpiling emergency funds far beyond what's reasonable (6-12 months).

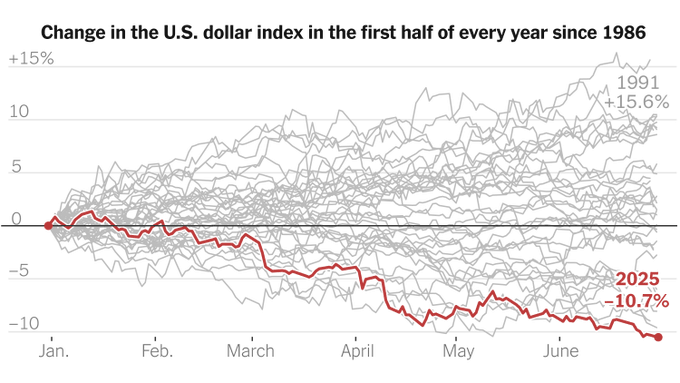

The reality is that the dollar lost 10% of its value already this year.

In other words, your dollar-denominated net worth has decreased ~10% in 2025. If your net worth didn’t grow more than that, you’re worth less than the beginning of the year.

This also means that any liquid cash not being invested or used for a purchase should be “working”, or earning, to continue growing in absolute terms.

We encourage working your way up to six months expenses in a high-yield savings account and investing the rest. These days, Cash is unfortunately not king.

Mistake #2: Overthinking Investment Selection

Too many early investors think that funding their Roth IRA is investing. So they drop money into their Fidelity or Schwab and wipe their hands clean.

However, that's just opening the door.

You still need to walk through it and pick actual equities, bonds or funds to deploy those dollars towards.

We realize this can lead to overwhelming choice and second-guessing yourself.

So rather than list a bunch of equities to pick, it’s best to start with a simple three-fund portfolio (Total Stock Market, International Stocks, Bonds) for wide coverage and middle-of-the-pack returns.

Three examples of three-fund portfolios

There’s always time to optimize later. Especially as you get deeper into your career, i.e. have more income to invest.

And if you’re a more advanced investor, you know which equities offer better risk-return profiles, but I digress.

Mistake #3: Emotional Investing

Market volatility can trigger panic selling or FOMO buying. A good solution to this is automating your investments and checking accounts monthly or quarterly, not daily.

While you want to be generally knowledgable about the goings-on of the market, too much exposure will create more cognitive load.

You already have enough going on, so it’s best to avoid doomscrolling financial news.

Building Your First Million(s)

Let's be honest: $1M isn't what it used to be.

Twenty years ago, million-dollar homes were rare. Now? That's your starter home in many markets.

What $1M buys you if SF…lol

Setting your financial independence or retirement goal on a specific amount like $1M can feel arbitrary, so do you really need a target at all?

Like all things, it depends on what you want.

The purpose of investing is not to hit some magic number like $1M, $5M or $50M.

It's about building habits that create the life you want. (Read Die With Zero if you haven't already.) Investing is but just one vehicle to achieve this.

Still, let's use $1M as our benchmark.

Assuming 7% annual returns and starting with $0:

Investing $2,000/month: Reaches $1M in ~20 years

Investing $5,000/month: Reaches $1M in ~11 years

Investing $8,000/month: Reaches $1M in ~8 years

A realistic timeline for physicians, based on average wages these days, could look like the following:

Years 1–5 (Residency, Fellowship): Build financial habits, contribute $50–$300/month

Years 6–10 (Early Attending): Ramp up to $1,000–$3,000/month

Years 11–16: Continue high contributions of $5,000/month or more; compounding accelerates growth, first $1M milestone reached

Year ~16–20+: Focus shifts to preservation, tax efficiency, and additional compounding

This is super rough math and your situation will undoubtedly look different. Take this as inspiration.

Compounding is the key, and your monthly contributions (given income phases) to achieve this target aren’t as daunting as you might think.

A few more physician-specific benchmarks could look like:

Age 35: 3x annual salary invested

Age 40: 6x annual salary invested

Age 45: 9x annual salary invested

Age 50: 12x annual salary invested

"The biggest mistake I see physicians make is waiting until they 'understand everything' before investing. Start with simple index funds and learn as you go. Time in the market beats timing the market."

Action Items

For Residents/Fellows:

Open Roth IRA with Vanguard, Fidelity, or Schwab

For what it’s worth, helping our friends in residency open Roth IRAs is how we came to starting The M.D. Those training years can be essential to building the capital foundation for true wealth and abundance later in life.

However, if you can’t contribute the $7,000 limit per year during your training, don’t fret. Even $50 goes a long way.

Set up automatic $50-300 monthly contribution

Choose target-date fund matching your estimated retirement year

Start the habit of tracking your finances–daily transactions, investments, debt–either with an app or spreadsheet

For New Attendings:

Immediately max out 401(k) contributions (set to at least 15% of salary)

If you haven’t, open a taxable brokerage account for additional investing

Research whether your 401(k) offers mega backdoor Roth option

Schedule quarterly portfolio reviews

For Established Attendings:

Calculate current net worth and investment allocation

Rebalance portfolio if more than 5% off target allocation

Optimize tax efficiency by reviewing asset location

Consider increasing investment contributions by 1-2% of salary

Key Stats to Remember

S&P 500 average annual return (1957-2023): 10.1%

Physicians who max out retirement accounts: Only 42%

Average physician retirement savings at age 50: $750,000

Recommended retirement savings by age 50: $1.8 million (6x $300K salary)

Cost of waiting one year to start investing at age 30: $132,000 at retirement (assuming $500/month contributions)

Conclusion: Your Prescription for Wealth

(Woof. Sorry, that was a lot of info. But hopefully the type of info you’re looking for. Let me know if not!)

Building wealth as a physician isn't about picking perfect stocks or timing the market—it's about starting early, automating everything, and staying consistent.

Your career demands focus. Family life is consuming. The world is increasingly distracting.

That's exactly why you need a system, not a strategy that requires constant attention.

Whether you're a resident with limited funds or an attending ready to accelerate wealth building, the principles remain the same: maximize tax-advantaged accounts, invest in low-cost index funds, and let compound interest work its magic.

Remember: You spent over a decade training to save lives. Spend at least a few hours learning to save your financial future.

The diagnosis is clear—physicians who start investing early and stay consistent become millionaires. Those who wait, struggle.

Your future self will thank you for starting today.

Feedback Corner

Anything you liked this week? Want to hear more about a specific topic? Reply to the email.

Meme of the Week

Check out RVU Tracker! We think it’ll be very useful for those who track work RVUs, log CPTs and track productivity. If you’re tracking with a personal spreadsheet today, give it a shot :)

Best,

M&H

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.